- InnerWorkings

- Posts

- Bold Bets And Cautious Outlooks: It's 2024 Outlook Season

Bold Bets And Cautious Outlooks: It's 2024 Outlook Season

As 2023 draws to a close, strategists and prognosticators are peering ahead to what the next year may bring. Will economic headwinds shift to tailwinds? Can geopolitical risks recede? Will business rebound and innovation accelerate? Expert outlooks for 2024 present a mixed picture - some are making bold bets on stronger markets while others harbor doubts and urge caution about lingering risks.

I read every 2024 Investment Outlook piece, so you don’t have to.

The purpose of going through this exercise is to not only double-check our assumptions but also to understand investor positioning. Hope you find these notes useful.

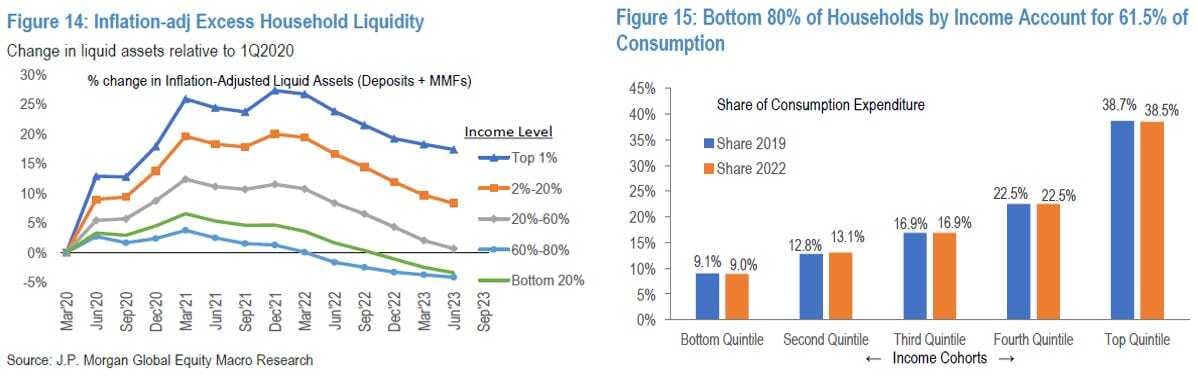

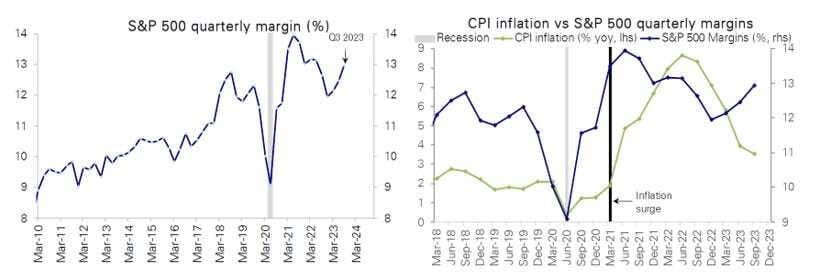

Dubravko Lakos-Bujas, JP Morgan

Target: 4200

Top Scenario

The Bottom 80% of customers are worse off, earnings may grow 1-2% and stocks will decline as multiples contract. Own bonds and bond proxies.

Bull Case

Energy offers a geopolitical hedge, while Staples and Health Care offer defensive characteristics. Overweight Quality stocks.

Bear case

Disinflation is the big catalyst for below-trend growth as tighter credit and lower Govt. stimulus pressure both Revenues and Margins. Margins could fall more than 100-150 bps.

A chart or two that I liked

Mike Wilson, Morgan Stanley

Target: 4500

Top Scenario

The Fed will start cutting rates in March as the slowdown accelerates. High and rising deficits will drive bond yields higher.

Bull Case

AI is impactful, leading to stronger economic growth. Additionally, the Fed pivots on falling inflation.

Bear Case

Fiscal support is expected to fade and monetary policy is starting to have an economic impact.

Negative credit growth in 4Q23 and 1Q24.

Negative conditions persist for much longer and S&P falls to 3850.

A chart or two that I liked

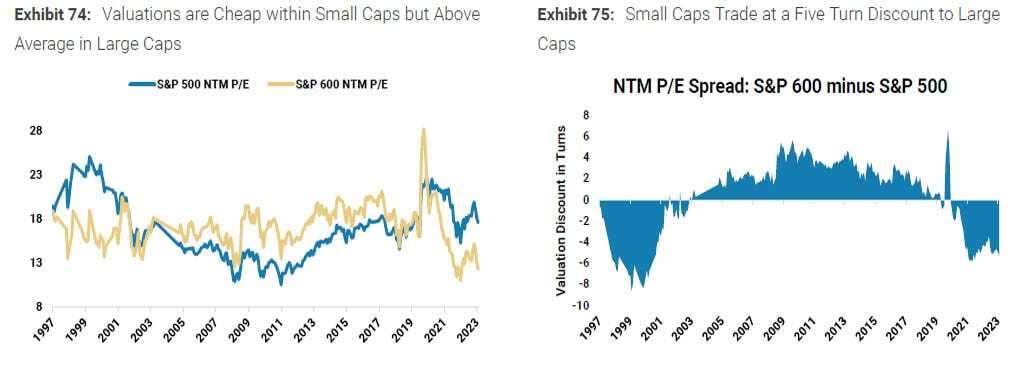

Barry Bannister, Stifel

Target: 4650

Top Scenario

Reflation as economic growth rebounds.

Rotation from cyclical growth to cyclical value in 1H24.

Supercore PCE is sticky which keeps the Fed from easing.

Bull Case

Small cap and cyclical stocks are the winners, outperforming Mega Cap Tech.

Bear Case

Sticky inflation keeps the Fed vigilant.

S&P peaks mid-year at 4650.

A chart or two that I liked

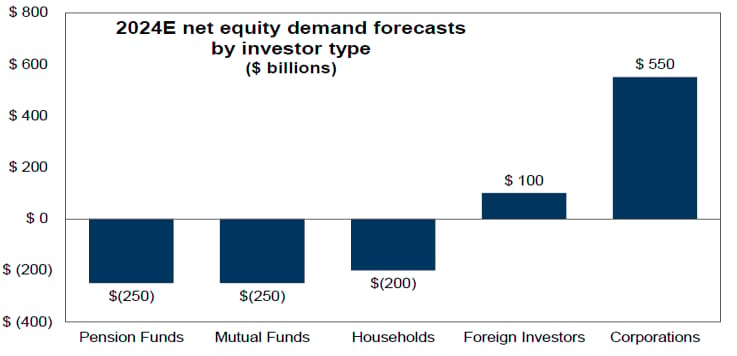

David Kostin, Goldman Sachs

Target: 4700

Top Scenario

Flat 1H.

2H Fed rate cuts and election uncertainty resolution will lead to gains in the 2H.

Bull Case

Barbell high growth and high ROIC companies, and cyclical laggards.

Bear Case

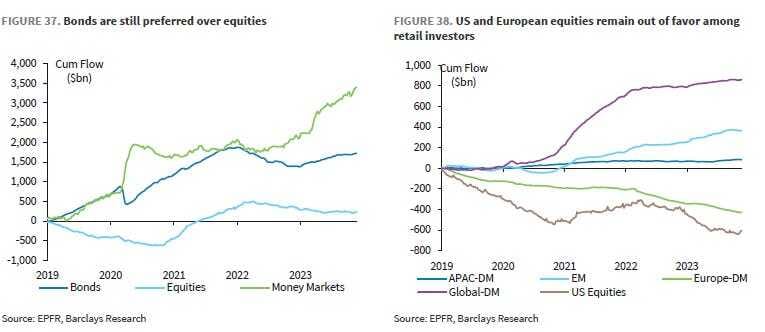

Households & pension funds will be net sellers of stocks and buyers of yield-bearing assets as rates stay higher than expected.

A chart or two that I liked

Venu Krishna, Barclays

Target: 4850

Top Scenario

Big Tech is the primary driver of S&P earnings as AI and stronger IT spending help.

Strong consumer balance sheets support discretionary spending.

Bull Case

A perfect landing leads to earning acceleration and 5500 S&P.

Bear Case

Activity will decelerate in 4Q23 and bottom with 1Q of contraction in 3Q24.

Disinflation, weak industrial production, and weak international growth will be a headwind for cyclical sectors

A chart or two that I liked

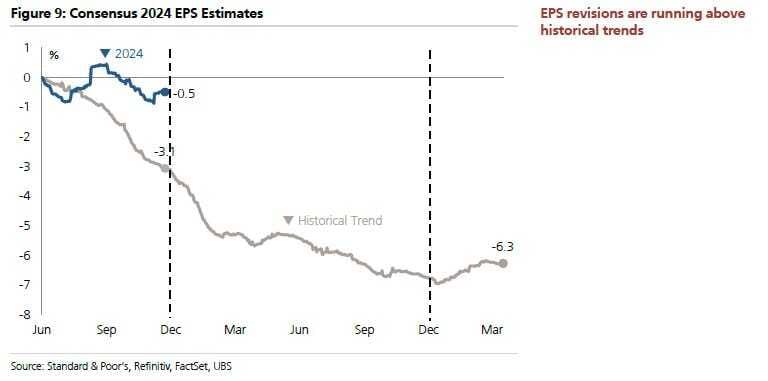

Jonathan Golub, UBS

Target: 4850

Top Scenario

A recession in the middle of the year.

Growth > Value and Small > Large.

Bull Case

Soft-landing leads to strong earnings growth and revenues, margins, and valuations all expand more than expected.

Bear Case

Wages are likely to fall slower than inflation in 2024, putting downward pressure on margins.

A chart or two that I liked

Lori Calvacina, RBC

Target: 5000

Top Scenario

By the time the Unemployment rate rises, Small Caps start outperforming the large caps. We are close.

Bull Case

Economic growth is broad. Small Caps outperform and Large Cap Growth loses its relative earnings advantage.

Bad Scenario

If we are entering a prolonged recession, Small caps will underperform by a lot.

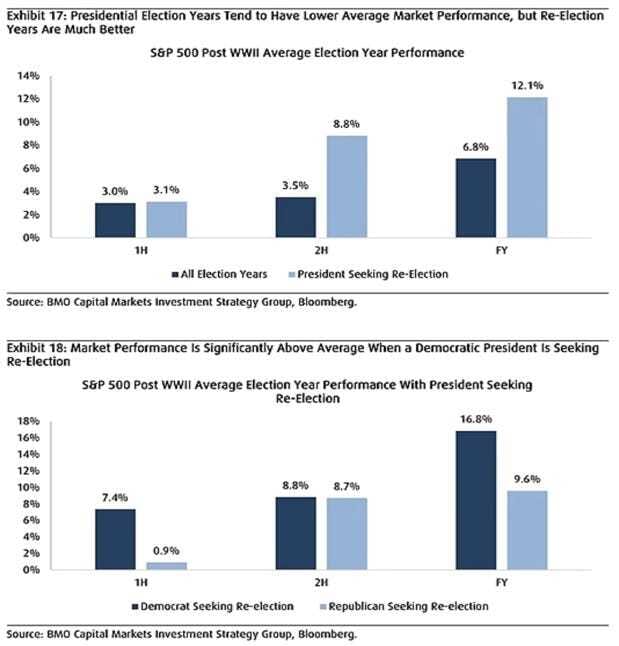

Brian Belski, BMO

Target: 5000

Top Scenario

Accelerating earnings growth will help the rally to broaden out.

Mid and small caps will outperform Large caps.

Base Case

Avg. performance of the 2nd year of the Bull market is 11%

Bear Case

The Fed will only cut if inflation falls below 2%. A chart or two that I liked

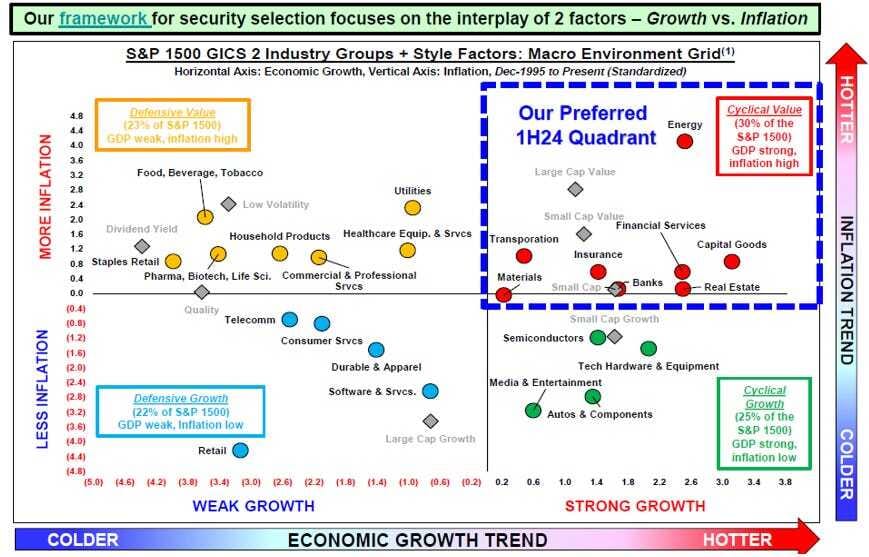

Binky Chadha, DB

Target - 5100

Top Scenario

A 10% base case and 19% bull case earnings growth in 2024. Neutral Mega cap growth and overweight cyclical and value sectors.

Bull Case

Earnings grow to $271 and multiple expands. S&P reaches 5500.

Bear Case

A shallow recession sometime in 1H.

The consensus expects inflation to fall quickly making further favorable surprises harder.

A chart or two that I liked

Tom Lee, Fundstrat

Target - 5200

(Not a sub)

Top Scenario

Bullish small caps and cyclicals.

Regionals are top picks.

Also bullish Mag 7, outperforms the S&P but has a tame year compared to 2023.