- InnerWorkings

- Posts

- The Guts of The Stock Market Is The Best Economist

The Guts of The Stock Market Is The Best Economist

The Guts of The Stock Market Is The Best Economist - Stanley Druckenmiller

Fed Powell Conference Call Highlights

· Economy expanding at a strong rate

· Housing flattened out

· Higher rates weighing on business fixed investments

· Jobs avg 266k, strong but below avg

· Nominal wage growth signs of easing

· Jobs to workers gap narrowed but exceeds supply

· Inflation remains well above 2%

· Core PCE up 3.7%

· Few months of good data is only the beginning (long way to go)

· LT inflation expectations well anchored

· Reducing inflation is likely to require below avg growth and soft labor conditions

· Two-sided risks have grown

Markets took the final statement as a strong signal that the Fed is firmly on pause and started a huge rally.

By the time the Fed is cutting rates, economic conditions have deteriorated. Markets do poorly. However, markets have a good track record of gains after a Fed pause. Please see the data below.

Source - Carson Wealth

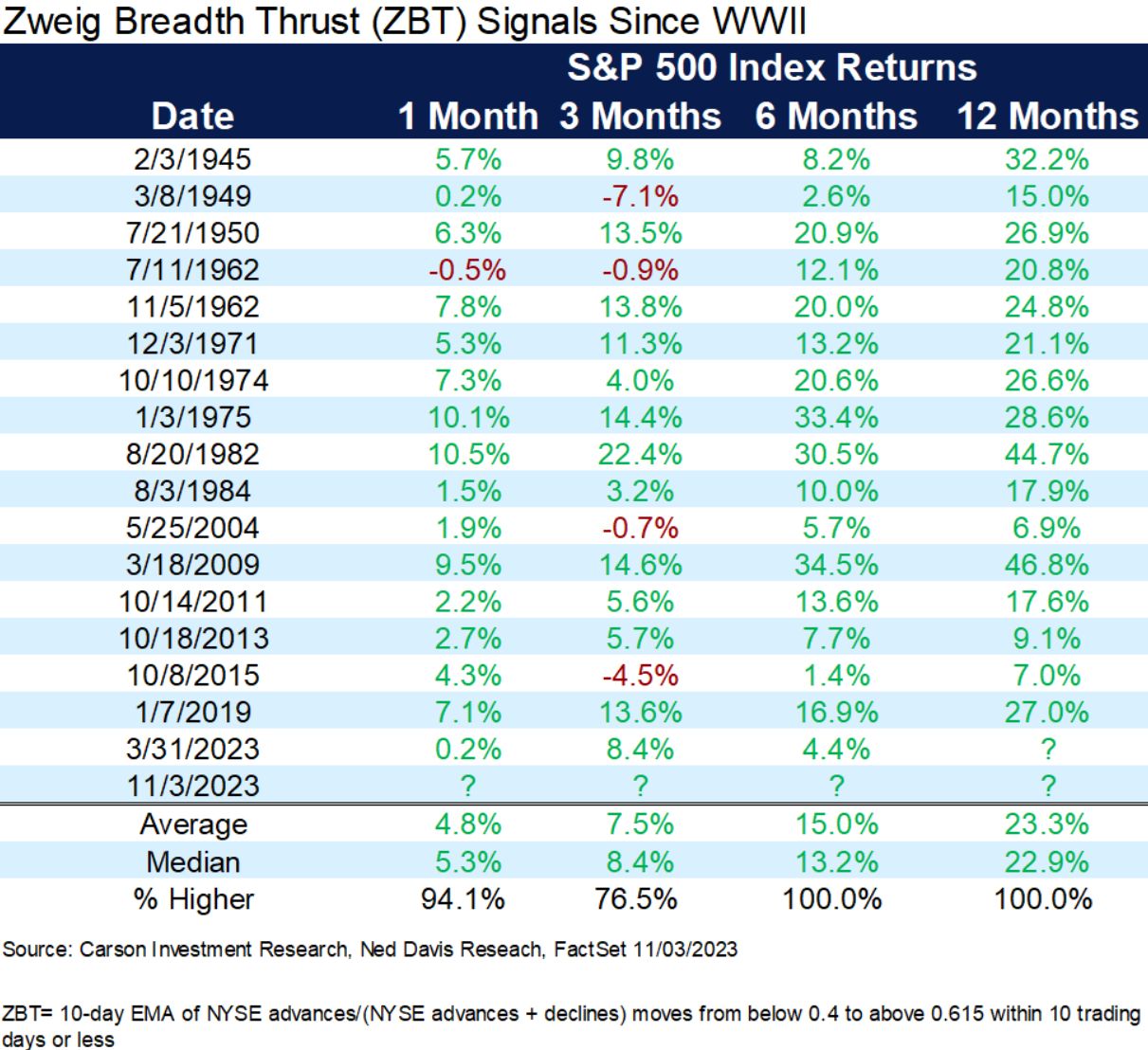

The strong market rebound triggered a rare Zweig Breadth thrust signal. It is a mathematical calculation of the NYSE advance + decline ratio. When the ratio moves from extreme oversold to extreme overbought within 10 trading days, markets do well over the next 6 - 12 months.

Source - Carson Wealth

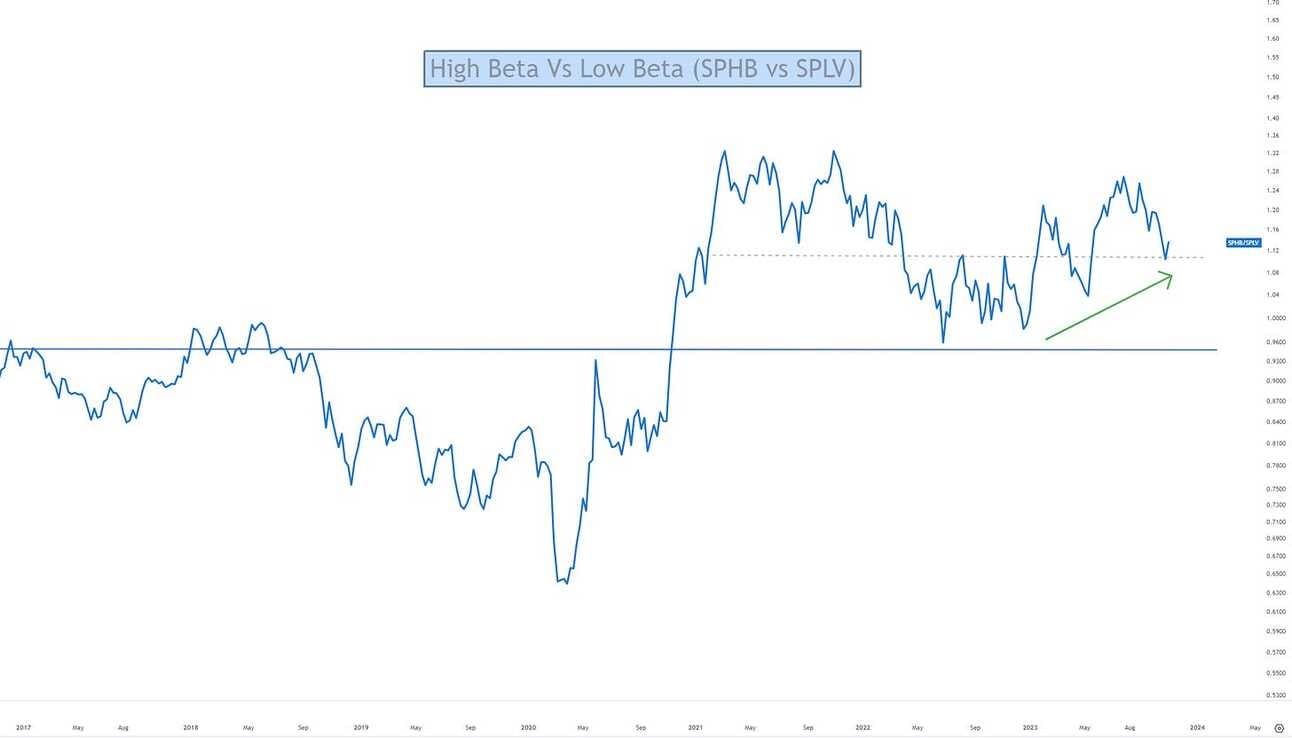

While the bearish sentiment reached a crescendo in October, there we no evidence of a true risk-off signal.

High-yield did not break down.

Neither did High Beta vs Low Beta

Nor did Eq. Weight Staples vs. Eq Weight S&P.

The Semis are a true cyclical gauge. Forget the transports. If the Semis underperform, watch out. However, they never did.

Lastly, the big Red Candle on the U.S. Dollar is a big ‘Green’ signal!

Have a great weekend.